My first authored papers are described below . Click on the images to enlarge them, on the titles for the full papers, or here for my CV.

JOb Market paper

|

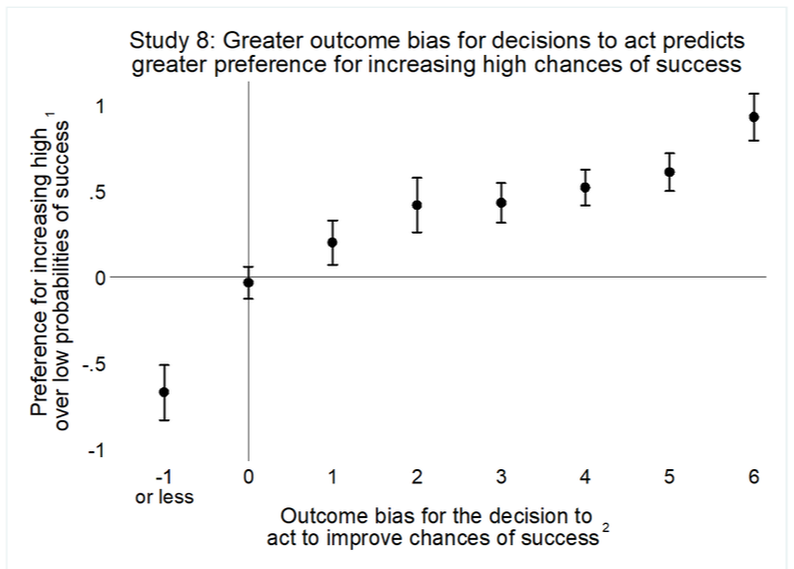

“Prospective Outcome Bias: Incurring (Unnecessary) Costs to Achieve Outcomes That Are Already Likely,” Journal of Experimental Psychology: General, 149(5), 870–888, (with Joe Simmons, 2020).

When do consumers overspend on products that improve their chances of success? People often buy products not because of the product's intrinsic value, but because the product improves their chances of attaining a goal. In hindsight, if this goal is attained, people feel like these purchases are justified, even if the product itself did not actually help. Consequently, people tend to overspend on products that increase their chances of goal attainment, especially when (1) their chances were high to begin with, and (2) when the stakes are high, but the impact of the product on their chances of success is very low. |

OTher Publications

|

“Extremeness Aversion Is a Cause of Anchoring,” Psychological Science, 30(2), 159–173 (with Celia Gaertig and Joe Simmons, 2019).

Is anchoring caused by consumers' aversion to making extreme judgments? Consumers are reluctant to give valuations of products that are too far from irrelevant-but-salient anchor values (such as list prices), because such judgments would feel extreme. They are also particularly averse to making judgments towards the edges of (or outside of) arbitrary ranges. Thus, telling consumers “The price is usually between $100 and $110, but you can get it for $50!” may be even more effective than telling them, “The price is usually $110, but you can get it for $50!” |

working papers

|

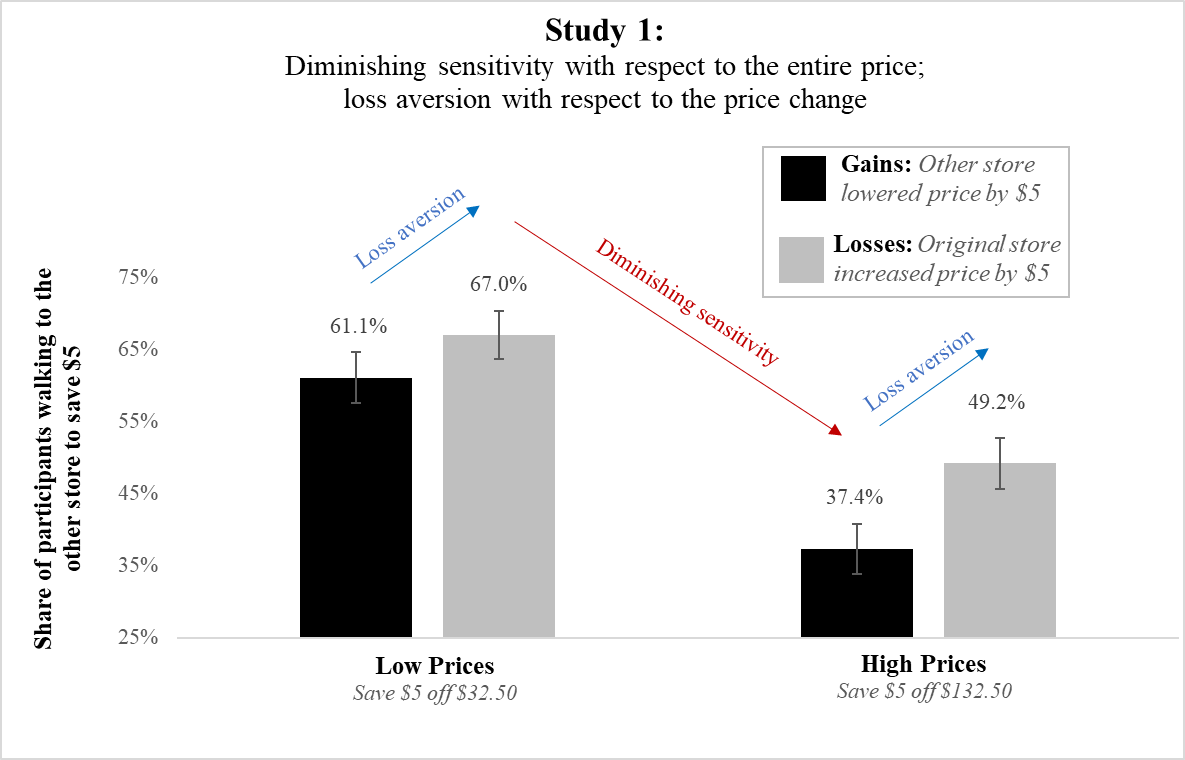

“Diminishing Sensitivity to Outcomes: What Prospect Theory Gets Wrong about Diminishing Sensitivity to Price,” (with Alex Rees-Jones, Uri Simonsohn, and Joe Simmons).

Why are consumers more sensitive to discounts off of lower prices? People are generally more willing to travel across town to save $5 off a (cheap) $15 purchase rather than to save $5 off an (expensive) $125 purchase. Prospect Theory purports to explain this phenomenon via diminishing sensitivity to losses, but my research suggests that people do not consider these payments to be losses at all. Instead, a $5 gain feels smaller relative to a reference price of $125 than a reference price of $15. Contrary to Prospect Theory, all $5 gains are not the same. |

|

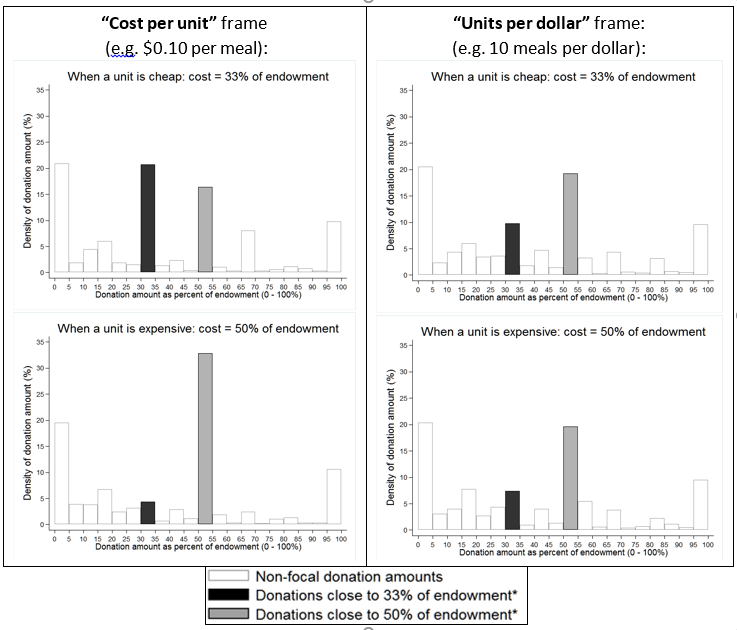

“Ineffective Altruism: Donating Less When Donations Do More Good,” (with Deborah Small).

Do people use information about charitable impact to donate more or less efficiently? When people see cost-effectiveness information about a charitable donation that is framed in terms of “cost per item” (e.g. $2 provides one mosquito net), they inefficiently donate less when the cost is lower. This result arises because people want their donation to have a tangible impact, and when the cost of such an impact is cheaper, people can achieve it with a smaller donation. A remedy for this inefficiency is to express cost-effectiveness in terms of “items per dollar amount” (e.g. 5 nets provided per $10 donated), thus leaving the cost of providing one net unstated and rendering it less salient as a target donation amount. |

|

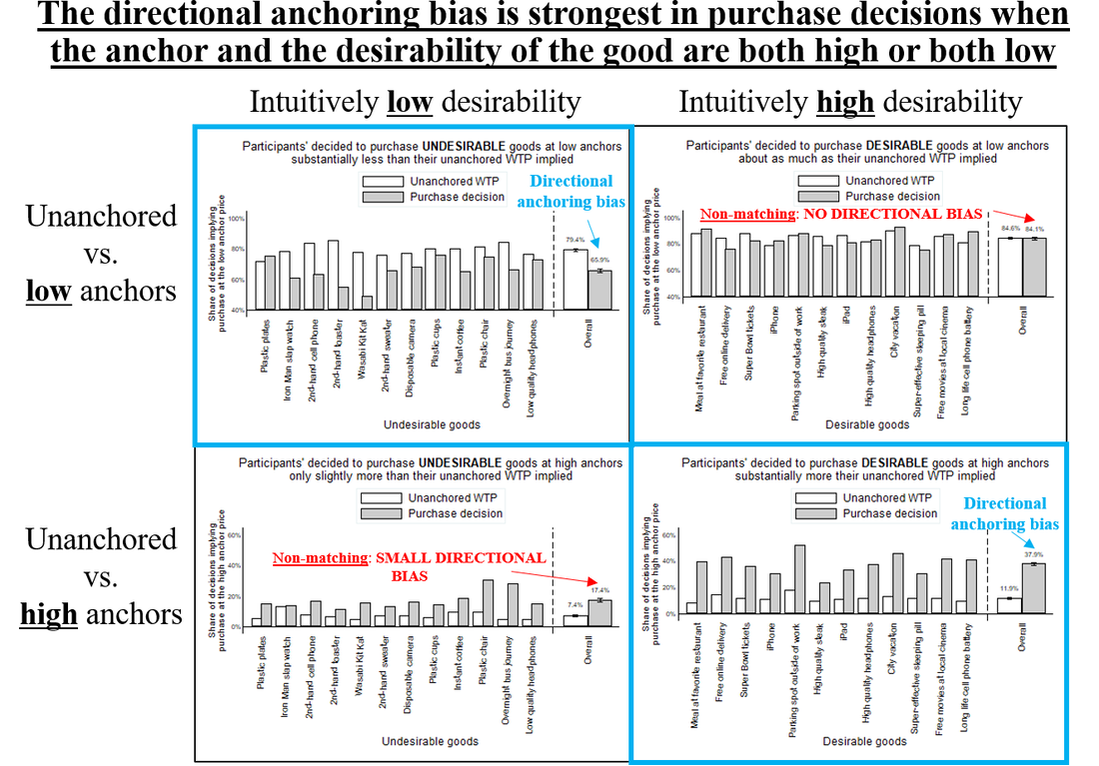

“Anchors Alter the Direction of Adjustment - Not Just the Magnitude,” (with Joe Simmons).

Are people too likely to buy high priced goods? Previous research on anchoring effects (wherein people make judgments that are too close to salient-but-irrelevant values, or “anchors”) attribute them to the extent to which people adjust their judgments from these anchors. However, I find that the direction of adjustment is a contributing factor. People are too likely to adjust upwards from high anchors and downwards from low anchors. I also find that prices act as anchors on consumers’ valuations. Consequently, consumers are too likely to buy goods at high prices due to disproportionately adjusting their valuations upwards from these high-price anchors. |